All in One Money App for Young Nigerians

Save Money. Grow Wealth. Spend Flexibly

Know the interest on your savings.

See how your money works for you

Financial Literacy Community

Improve your money skills and have direct access to opportunities.

Join our Financial Literacy Community

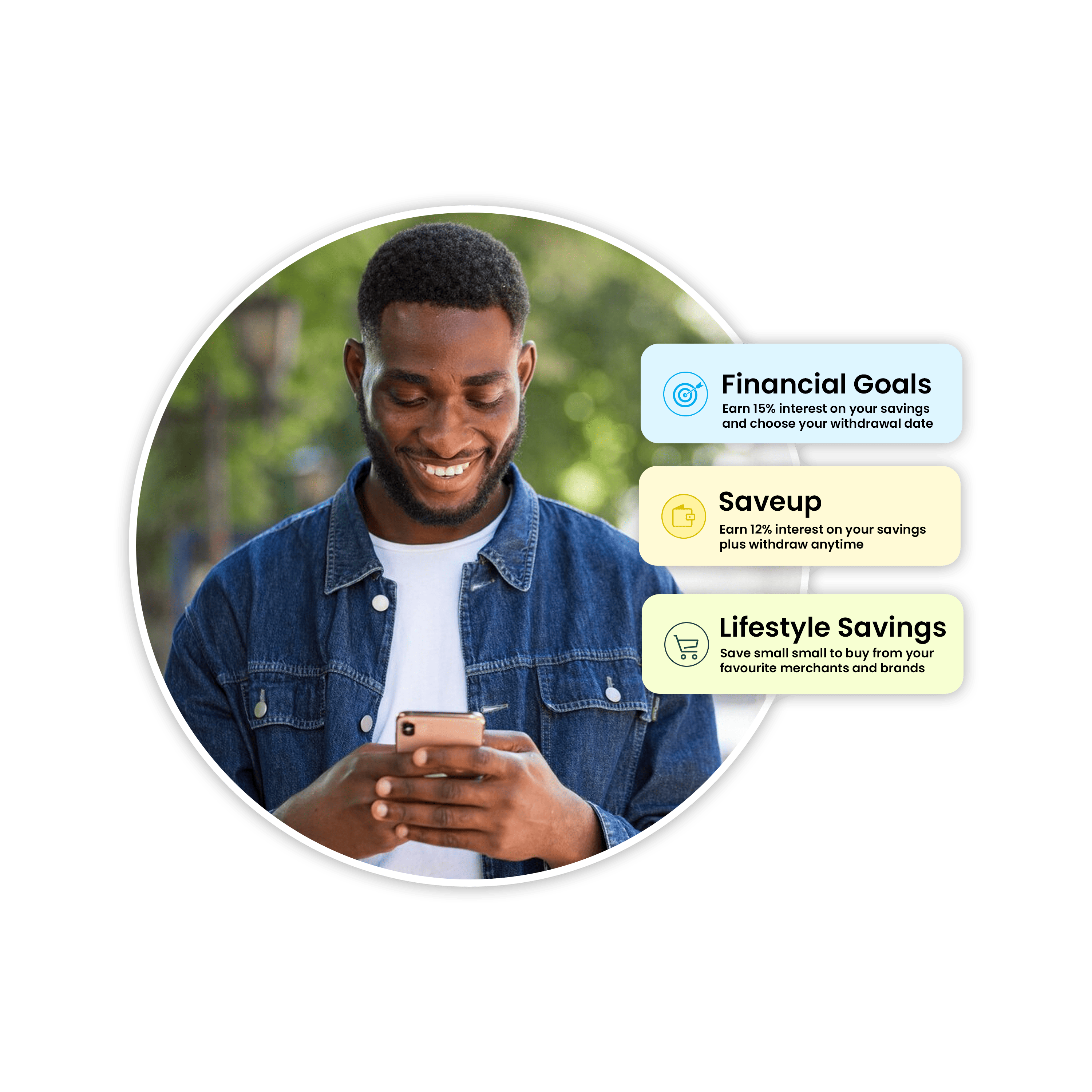

Save for a Financial Goal

Saving for a financial goal helps you achieve discipline and consistency in your savings goal.

Learn more Save UpBuild your savings without limits. Enjoy monthly free withdrawal Turn on Automatic Savings to be ConsistentLearn more

Save UpBuild your savings without limits. Enjoy monthly free withdrawal Turn on Automatic Savings to be ConsistentLearn more

Automatic Savings

Automate your savings and build wealth consistently with your savings on autopilot. Conveniently set up your automation settings daily, weekly, or monthly

Halal SavingsBuild wealth according to your Islamic faith. Be among the Muslims who use SavetoBuy to save the Halal way without interest.Learn more

Halal SavingsBuild wealth according to your Islamic faith. Be among the Muslims who use SavetoBuy to save the Halal way without interest.Learn moreTop Security that keeps your data and account safe.

SavetoBuy uses industry standard security to protect your information and keep your account safe.

Frequently Asked Questions

What is savetobuy?

- SavetoBuy is a secured savings platform that allows you to save for your purchases and earn cash rewards. With SavetoBuy, you can also build wealth using our high yield interest savings account for up to 15% interest per annum

What are the different features on SavetoBuy?

- SavetoBuy Lifestyle: Save to buy from your favorite merchants and earn cash rewards

- Financial goal: Disciplined way to save for a target, up to 15% per annum interest

- Saveup: Flexible savings, withdraw for emergencies, upto 12% interest per annum

- SavetoBuy Merchant: Free website for your business, collect installment payments conveniently from your customers

There are four features on SavetoBuy

How to create a SavetoBuy account?

- Visit the website

- Click on sign up, to create an account

- Fill in your Name, Phone number, Email and create a password

- An OTP will be sent to your Email to verify your email address

- Input the OTP to verify your Email address

- Congratulations you have successfully created an account with SavetoBuy

To create a SavetoBuy account

What does KYC mean?

- The KYC step is important because it validates your identity and protects you against Identity theft and financial fraud

KYC means Know Your Customer.

How do I automate my savings

- To automate your savings you need to add your Debit card and enable automatic savings on your preferred savings feature.

What is savetobuy?

- SavetoBuy is a savings platforms

Official Channels - Contact Us (Email and Social Media)

- What are your official channels - email Our official channel via email is support@savetobuy.io

- What are your official channels - social media You can reach us via these channels: @usesavetobuy

- Instagram: https://www.instagram.com/usesavetobuy/

- Tiktok: https://www.tiktok.com/@usesavetobuy

- Twitter: https://twitter.com/UseSavetoBuy

- Facebook: https://web.facebook.com/usesavetobuy

- Youtube: https://www.youtube.com/@usesavetobuy

Do not reach out to channels outside of these channels listed below

What is SavetoBuy Lifestyle?

SavetoBuy Lifestyle helps you save for your purchases with your favorite merchants. You can save to buy in installment, buy when you complete your savings and earn cash rewards.

What are the things I can save toward with SavetoBuy?

SavetoBuy is a complete lifestyle solution for you. You can save for anything you desire on SavetoBuy. Phones, Laptops, Beauty Products, Perfumes, Vacation, Designers and so much more

How do I use SavetoBuy Lifestyle?

- Visit www.lifestyle.savetobuy.io

- Select the product you want to SavetoBuy

- Choose the number of installments

- Start saving for your product

- Pickup or Request for delivery when you complete saving for the product

To use SavetoBuy lifestyle

How can I fund my savings?

- Manually Please note: To fund manually, you need to first fund your wallet with the amount you wish to add to your savings.

- Once you have created a savings plan, it is time for you to fund your plan

- Click on your savings plan

- Type in the amount you want to save

- Choose a payment method; you can either choose to pay with a card or pay with your wallet.

We encourage your SavetoBuy lifestyle to be automated by adding your card to your account. Your savings plan can be funded in two ways: Manual Savings and Automatic Savings

How can I set up automatic savings?

- First, add your debit card to your account.

- To turn on automatic saving, go to plan details or automatic savings setting.

- Click "Turn on automatic savings".

- Setup the amount, frequency, and the time you want to be automatically debited.

- Save your settings.

To set up automatic savings, follow these steps:

How long does it take to make a purchase on SavetoBuy Lifestyle?

- You can pay outrightly for your purchase.

- You can save installmentally on a daily, weekly, or monthly basis for your purchase.

- Complete saving for your purchase to request for pickup or delivery

Saving for a purchase on SavetoBuy is very flexible. You have two options:

Can I pay at once for a product?

- Yes, you can pay at once for a product.

What is a cash reward?

- This reward will be paid into your SavetoBuy wallet.

- You can then withdraw it into your bank account.

A cash reward is the money you receive when you complete saving for a purchase and make a purchase on SavetoBuy.

Why am I getting a cash reward?

- We encourage our users to build good financial discipline by saving for their purchases.

- The cash reward serves as a recognition of your commitment to financial discipline.

We are rewarding your financial discipline and consistency in saving for your purchases.

Can I request for a refund if I change my mind about a product?

- A refund fee of 7.5% will be deducted from the amount you have deposited for the product.

- When you request for a refund, the refunded amount will be paid into your SavetoBuy wallet.

- You can then withdraw it into your bank account.

Yes, you can request for a refund. Please note the following:

How and when do I collect the item I am paying for?

- You will need to arrange delivery with the merchant.

- You can either choose to pick up the item or request for a delivery based on your agreement with the merchant.

You can collect the items you are paying for when you complete your installmental payment.

How do I account for delivery cost?

- You can arrange for pick up of the item if available.

- Make sure to consider the delivery cost when budgeting for your purchase.

The delivery fee will be communicated to you by the merchant at the point of purchase.

Can I save for multiple items at the same time?

- Yes, you have the flexibility to save for multiple items simultaneously.

What if the product I want to buy is not available?

- Give us a week for the merchant to restock the product or provide an alternative.

- If the merchant is unable to restock the item, and you do not like the alternative offered, your money will be refunded.

In such cases, please follow the following steps:

What if the product I want to buy becomes more expensive or cheaper when I reach my target savings?

- If the product becomes cheaper when you reach your target savings, you will get it at the new lower price.

- If the product becomes more expensive, the price will change accordingly.

- To secure a specific price, it is recommended to complete your installmental payment on time before prices may go up.

- However, when you lock down a price, you will get the product at that price regardless of any subsequent price changes.

Product prices may change based on market realities. Here is what happens:

Can I buy insurance on my products?

- Yes, you can buy insurance for products that have insurance enabled on them.

What is financial goal savings?

- You can earn up to 15% per annum interest on your savings target.

- You will be able to withdraw your money when you reach your maturity date and target.

- The financial goal feature helps you build consistency and discipline while saving towards a financial goal.

- You can set it up to automatically deduct money from your bank account, eliminating the need for manual savings.

Financial goal savings is a disciplined savings option with the following features:

Is the Financial goal right for me?

- You have a specific savings goal in mind, such as Rent, Fees, Wedding, or Buying a new car.

- You desire discipline and want to prevent yourself from withdrawing before reaching your target date.

- You prefer automated savings to ensure consistent progress towards your financial goal.

The financial goal feature is suitable for you if:

What is my interest rate on financial goal?

- The interest rate for the financial goal savings is up to 15% per annum.

Can I create more than one financial goal?

- You can give each savings plan a name, such as Rent, Vacation, Birthday, etc.

- This allows you to save towards different financial goals simultaneously.

Yes, you can create multiple financial goal savings plans.

How often can I withdraw from my Financial goal account?

- You have reached your maturity date and target.

- Until then, the funds in your Financial goal account are not available for withdrawal.

You can only withdraw from your Financial goal account under the following conditions:

Can I cancel my financial goal plan?

- Cancellation of a financial goal plan comes with a penalty of 2.5% on the amount you have saved.

- This penalty is applied to discourage cancellation and maintain the discipline of the savings plan.

Yes, you can cancel your financial goal plan. However, please note the following:

What is SaveUp?

- You can earn up to 12% per annum on your savings.

- SaveUp allows you to withdraw for emergencies while still maintaining discipline in your savings habits.

- You are entitled to one free withdrawal every month on SaveUp.

SaveUp is a flexible savings option with the following features:

Can I use automatic savings on SaveUp?

- You can set up your automation settings with the desired amount, frequency (daily, weekly, or monthly), and we will assist you in saving based on these settings.

- Automating your savings helps you maintain a consistent savings habit and grow your savings over time.

Yes, you can automate your savings and increase your money consistently on SaveUp.

Is SaveUp right for me?

- You want to save as much as possible without a specific target in mind.

- You need the flexibility to withdraw part of your savings, especially for emergencies.

- You prefer the option to automate your savings and increase your savings consistently over time.

SaveUp is suitable for you if the following criteria match your needs:

What is the interest rate on SaveUp?

- The interest rate on SaveUp is up to 12% per annum.

How often can I withdraw from my SaveUp account?

- You are allowed one free withdrawal per month from your SaveUp account.

What happens when I exhaust my free withdrawal?

- You can still make additional withdrawals from your SaveUp account.

- However, withdrawals outside your free withdrawal period will incur a fee of 2.5% on the amount being withdrawn.

- This fee is applied to encourage discipline and discourage frequent withdrawals.

If you exhaust your free withdrawal, please take note of the following:

Become smarter with money in just 5 minutes.

Enjoy regular personal finance tips and education from us for free!

Unsubscribe anytime.